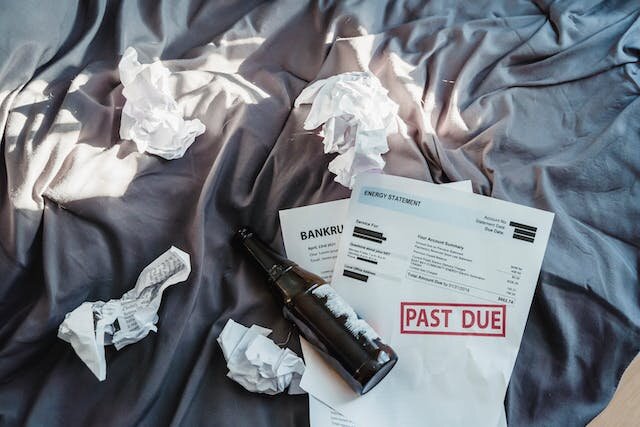

Handling your finances requires that you understand how to address your income and expenditures so that you only end up spending what you can afford. Sometimes, you can risk and invest the funds in a promising investment, though there is a possibility of losing the funds and falling into bankruptcy. An investment professional can guide you in your investment journey to avoid making huge investments in areas with no promising returns. Falling into bankruptcy has numerous repercussions, like losing your home to offset a loan or other financial obligations. Innovative approaches can be explored to leverage home sales as a strategic tool for preventing bankruptcy and ensuring financial stability, and this has saved many people facing bankruptcy.

Filing for bankruptcy comes with several benefits, though it can also come with disadvantages. What is the Downside of Filing for Bankruptcy?

One downside of filing for bankruptcy is an immediate large and negative impact on your credit score. Bankruptcy will remain on your credit report for seven to 10 years. As a result, it will be more difficult and more costly to borrow money. Depending on the type of bankruptcy, you could lose assets like your home and car. (1) There are different ways to leverage home sales and save you from bankruptcy, and highlighted below are some of the options that you can exploit.

Early Intervention and Financial Literacy

Early intervention and financial literacy are the first steps in bankruptcy prevention, giving you financial knowledge of your current situation. A proper understanding of your situation guides you to understand your finances fully, and there are different programs to equip you with the appropriate knowledge. The other programs include budgeting, responsible borrowing, and saving, all of which empower you to make sound financial decisions that do not lead you to a risky financial situation. Also, early intervention creates room for the detection of potential economic issues before they grow into serious situations, giving you an opportunity to consider sell my house fast Seattle as an option. With proper financial knowledge and planning, selling your house is a strategic decision that saves you from bankruptcy.

Strategic Home Sales

Selling your home shouldn’t be considered a last resort towards saving yourself from the critical financial problem you find yourself in; instead, it is a strategic decision. Selling your home before reaching the extreme position gives you enough money to handle other financial issues like debt and even create an emergency fund while leaving you with enough cash to invest. Sell My House Fast Everett, WA offers you fast house sales services that give you the money you need to streamline your finances and save you from falling into bankruptcy. The consequences of bankruptcy are very detrimental; hence, selling your home is a strategic way of overseeing your finances and not letting them stress you into bankruptcy.

Debt Restructuring and Mortgage Modification

In as much as selling your home is a strategic decision, first, you should consider restructuring your debts and modifying your mortgage. The two options give you some financial pressure release, giving you more time to get extra cash and manage the cash in your pocket well without constantly spending all your money to pay debts and mortgages. The benefit of this option is that you get to adjust the terms of your repayment, reduce the interest rates, and even consolidate debts, enabling you to manage them well. The different avenues should first be tried, and if you see that you can’t still manage your finances as you’d expect, then you should get in touch with Sell My House Fast Everett to sell the property.

Realizing Home Equity

As a homeowner, you need to know your home equity, as this is an asset that can help you avoid bankruptcy. Realizing the home equity through sell my house fast in Everett, WA, is a game changer since, when converted to cash, it can help you settle pressing financial issues like debts and use the remaining funds to invest in income-generating opportunities. Home equity gives you the financial cushion you require to save yourself from bankruptcy; hence, as a homeowner, you should always know your home equity.

Community Support and Housing Initiatives

Community support and housing initiatives have helped a great deal to prevent homeowners from falling into bankruptcy. Communities know the importance of such initiatives, which include financial counseling and temporary housing solutions. We buy houses Seattle sales for a fair price that gives you the right amount depending on the cash home buyers in Seattle property market prices. The various initiatives help every homeowner within the community to have a good grasp of their finances, minimizing the possibility of having a distressed property.

Legal Protections and Consumer Rights

Legal frameworks exist to protect individuals from unfair practices and provide avenues for negotiating with creditors, preventing creditors from taking advantage of you. Being aware of these protections can empower you to navigate your financial challenges more effectively and deal well with creditors for lower interest rates and even more time to clear the debt. Additionally, legal experts can guide potential alternatives to bankruptcy, including the strategic sale of assets like homes. The legal professionals recommend you understand the different options at your disposal and how you can leverage your home to escape bankruptcy. You get advised well so that you make an informed decision that saves your finances and one that you do not end up regretting in the future.

Conclusion

Bankruptcy is a dire financial situation that affects you in so many different ways; hence, it is essential to take all the necessary measures to avoid it. Those mentioned above are a few of the things you can consider to protect yourself from falling into bankruptcy and getting stranded on how to handle your finances. Leveraging home sales as a proactive measure to prevent bankruptcy requires a shift in perspective and a commitment to financial literacy and early intervention. By realizing home equity and exploring alternatives before reaching a point of extreme distress, individuals can secure their financial stability and build a more resilient economic future.